In the ongoing scenario of digital transformation, the finance sector is on top of the industries embracing new techno-fused solutions. Ever since the market witnessed the modernization of existing technologies, the constant evolution of FinTech continued to empower millions of startups & ventures propelling across the banking segment.

A recent report by PR News states that the global Fintech market is anticipated to reach $305 billion by the end of the year 2025. Over 60% of credit unions & 49% of banks admit that fintech partnerships are imperative to induce their business growth.

Well, there are tons of fascinating stats to justify the reasons behind the gradual spike in the figure of businesses investing in fintech app development. Though it’s quite clear that Fintech is all set to revolutionize the banking sector, it’s high time for financial institutions to strengthen their service areas with futuristic digital solutions.

The idea of getting a robust banking application or Fintech platform for potential users is imperative to get a full-proof product development strategy at priority.

Just give a speed read to this blog to learn the ins & outs of creating a stellar app based on fintech with an expert’s guide to Fintech app development.

All About Fintech app development: An Overview & Types

Before proceeding further to the guide on Fintech app development, designing, & technology things & top trends that will transform the future of Fintech, let’s get back to the basics!

If we solely talk about Fintech, the possibilities of experiments & innovations are endless for the startups intending to broaden their service areas in the finance & banking sector. furthermore, the concept of Finance + Technology goes well with businesses dealing with banking & finance services.

From mobile banking to digital payments, e-wallets, & other modes of transacting online, Fintech is transforming the banking sector in many ways. Needless to say, Fintech app development is not only worthwhile for corporate survival but also for keeping a match with customers’ preferences.

No matter how convincing these statements seem to be, the success rate of every mobile app idea is questionable if it fails to meet the purpose.

Like Hie HQ, a top-ranked product development agency to rely on.

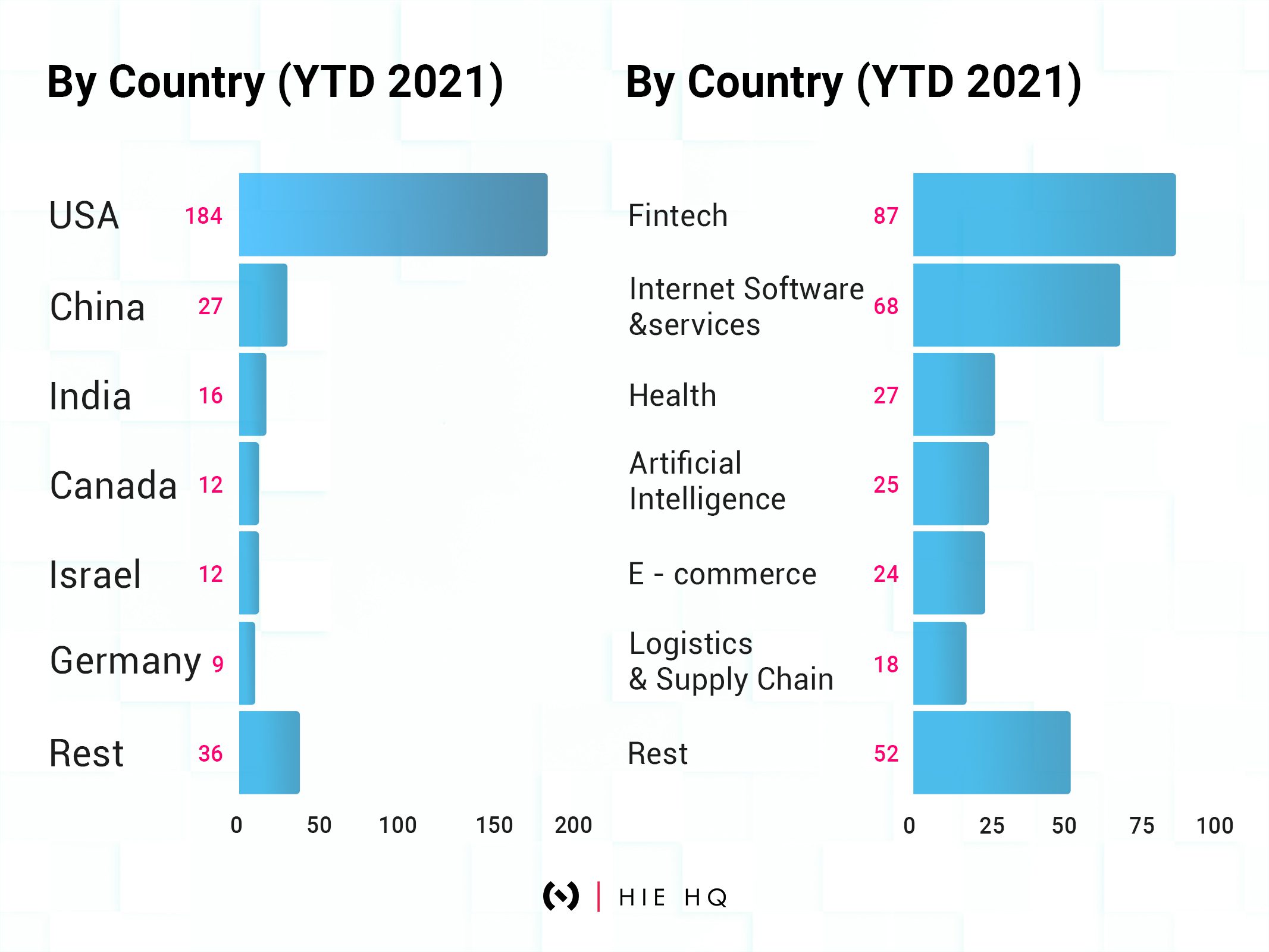

Take a look at the below graph as you scroll down to the next section.

Now it’s crystal clear that the Fintech industry is on the way to growing exponentially in the coming future. So, what’s next?

While we move on to the topic, just take a moment to go through these peculiar categories in demand for Fintech app development:

1. For Online Banking

The era of digital banking paved the way for the innovation of fintech applications. More & more banks are introducing their software to simplify banking for their clients.

Fintech apps ensure that users won’t have to hassle with bank transactions, making it easier for banks to record their clients’ data as well. At the same time at Hie HQ, a developer’s guide to banking app development like Revolut

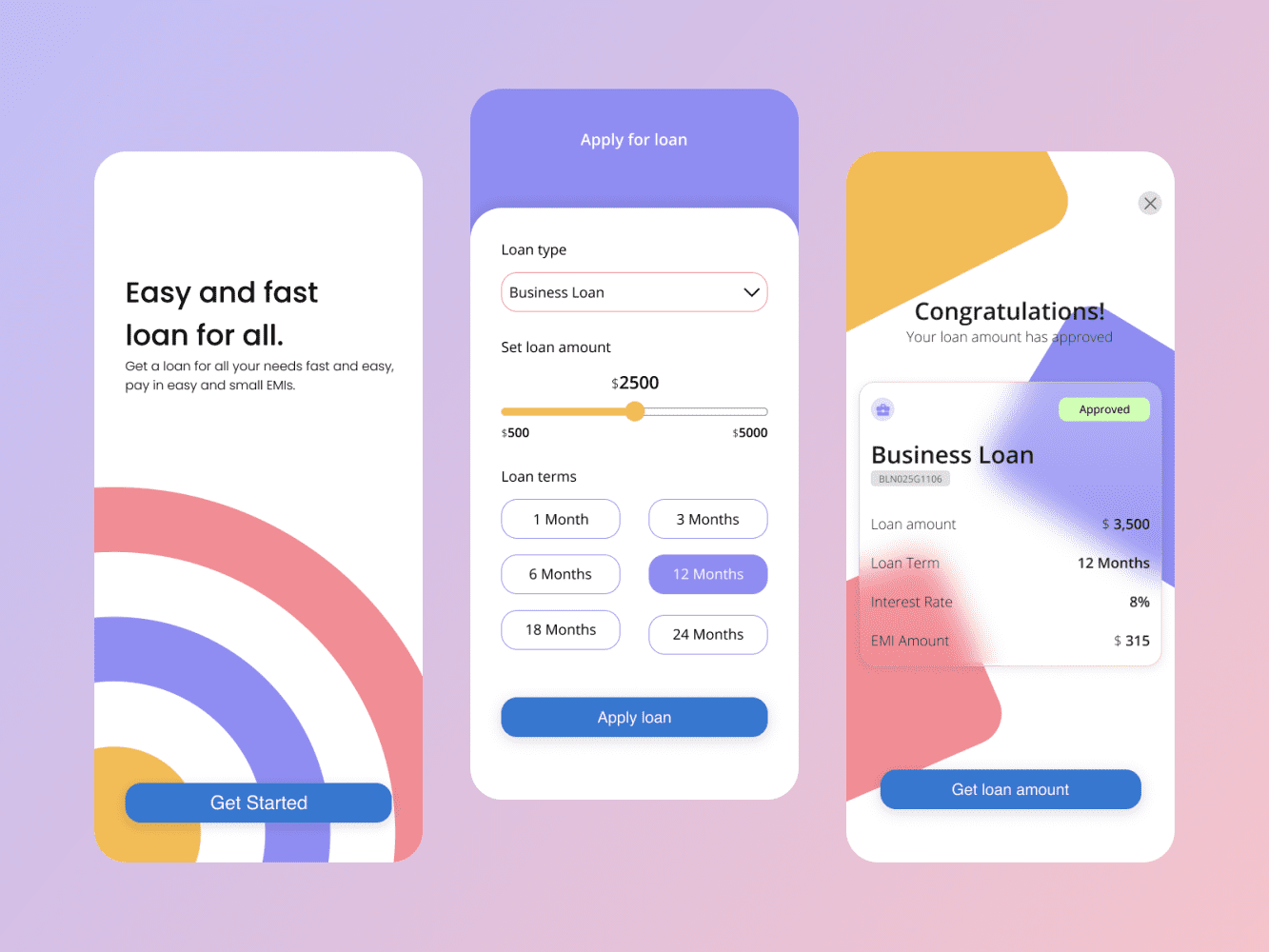

2. For Online loans or lending

Fintech is a one-stop business solution in loan facilitation. Banks, as well as individual loan providers, count on end-to-end software products to streamline the procedures of loan disbursement & settlements.

Learn how to develop loan-leading apps like MoneyLion & TrueLayer

3. For Stock market investments

Online traders find it more convenient to conduct their stock market transactions or investments on finance apps such as Robinhood. The immense popularity of Robinhood-like stock trading apps among investors who’re desirous to get stock market updates & insights to make the right decisions about their financial investments.

4. For personal finance management

One major aspect of Fintech app development involves consumer-oriented services for personal finances. Therefore, Fintech apps dissolve complicated calculations & management of day-to-day transactions done through bank accounts.

Such Fintech apps are integrated with exclusive features to manage expenses, plan a budget, & monitor accounts with no inconvenience at all.

How Hie HQ can help you in end-to-end Fintech app development?

Developing a Fintech app is not an easy-going task indeed, but not so challenging of course!

Both teams of UI/UX designers & developers shall have to collaborate to craft a robust Fintech app with out-of-box features.

However, only experienced & trusted Fintech app development service providers ensure the success of an app. Being a business owner, you must have some sound knowledge of the development process.

Just take a note of the most prominent steps of building a fintech app:

Step 1: Outlining your business goals

Whether it’s about e-banking or e-wallet services, an idea proposed for a Fintech app must match the needs of potential users.

Be clear about the type of fintech app you’re investing in. And to stay on the right track, it’s important to determine your niche first so that you can step ahead in the Fintech app development process without being dilemmatic.

For instance, if your mobile app is meant for clients needing finance advisory & consultations such as Robo Advisor then it will be better to get a deep understanding of what exactly its target users will be looking for.

Step 2: Ensuring Legal Compliances

After choosing a definitive niche or user base, the next important step is considering legal compliance in the Fintech app development.

Fintech apps or e-wallet apps are more about the security & privacy of users across the global corners. Moreover, every country or region brings a particular policy or rules for legal compliance for financial institutions and banks.

Correspondingly, almost every Fintech firm is concerned about legal compliance with apps or software they use to facilitate their clients as it’s crucial to avoid certain legal disputes in the future.

Step 3: Defining must-have features & budget

The next phase of Fintech app development highlights prerequisite features & budgeting. For example, if we talk about an advanced money transfer app & a new-age money management app, then there will be a significant difference in their features & functionalities.

And when it comes to the development cost of Fintech apps, it depends on the type of app i.e native or hybrid, technologies used i.e frameworks & toolkit, a team of developers, features, & much more.

Let’s discuss some of the core features of any fintech app:

- Payment gateways to enable seamless transactions via any payment mode on the app.

- Transaction history option to keep track of the recent transactions on the fingertips.

- Adding bank cards to conduct securer, faster, & easier transactions in a few clicks.

- Push Notifications to get notified about the latest updates & money transactions right in one place.

- Biometrics login provides user verification & authentication for one-click signup & login to the account.

- Referral system to reward users for every unique referral to their friends, relatives, etc.

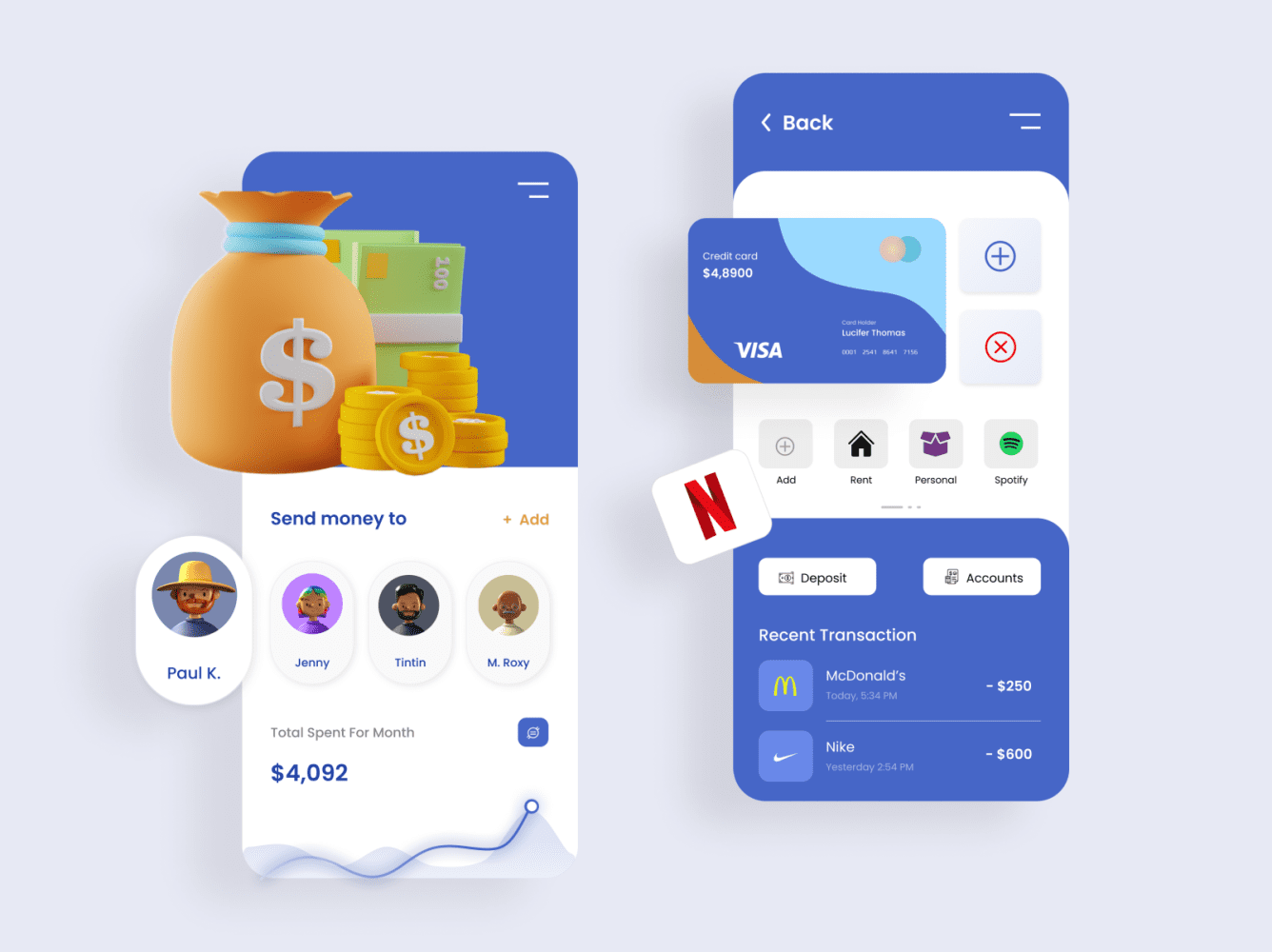

Step 4: Creating UI/UX Designs

Like any other app, the user interface of a Fintech app must be designed with a minimalistic approach. Therefore, we should mind the fact that UI/UX design is an aqueduct b/w designers & users to come up with a user-friendly app that holds the potential to engage users with every single click.

UI/UX designers are adept at creating designs that not only attract users with capitative elements but also simplify navigation throughout the app. And so, our creative experts implement the best practices to boost the overall accessibility of the product we co-build together with our clients.

Step 5: Building MVP

MVP stands for Minimum Viable Product & it is created in the early stages of Fintech app development. Hence. software product developers do consider building an MVP i.e proof of concept for the very first response.

Therefore, early feedback is much-needed to ensure mobile app success & this can only be achieved with MVP.

MVP is an initial presentation of features & functionalities of an app that serves options to conduct a test run. Experts say that MVP eliminates the risks of app failures as developers consider the responses they receive before stepping further into the coding process.

Step 6: Providing support & maintenance

Apart from the development, testing, & deployment part, a Fintech app development company actively participates in the app maintenance & support process. Consequently, even after project completion, developers take responsibility to conduct regular app updates & offer immediate support against technical issues.

Key Takeaways

The key stages of Fintech app development are similar to the prevailing product-building procedure. Hence, it doesn’t matter if your app idea is completely based on a new concept or relatable to existing ones, its uniqueness matters a lot and this can only be achieved with the mastery of brilliant tech minds.

App ideas shall come & leave but only a few of them are realistic enough to turn into a successful app. All you need is a future-centric product development strategy to make zero-risk investments to ensure your business’s success.

Where else can you go? Hie HQ is a trusted product partner of various reputed brands & groups established in the global marketplace. At the same time, we’re backed by a team of highly experienced & super competent product engineers committed to shaping high-grade product innovations for modern startups, SMEs, & growing organizations.

As a result, we take pride in being the most promising product partner with our deep expertise in building custom products of various genres including Finance & Fintech, Social & Community, Fitness & Healthcare, SAAS-based software solutions, BLE & IoT-powered products, eCommerce, Gaming, Blockchain, AL/ML products, & more.

We’re spearheading the domain of product planning, product design, and product development, DevOps, Security & Compliance, backend development, third-party API integration, and mobile & web app development. At Hie HQ envision the feasibility of the product idea to further conceptualize & strategize with our startup-centric approach to co-build path-breaking software products of superior quality. We ensure client satisfaction & on-time delivery on every project we handle. We value your trust, time, & business needs. Our flexible engagement models & round-the-clock customer support keep us ahead of the competition.

Just take a deep breath & contact us to discuss your idea. Get in touch to get started today!

Also, take a tour of our portfolio to explore our latest work.

FAQs

1. What are the major categories of Fintech app development?

The most popular categories of Fintech products are digital lending, online banking, stock & trading, smart budgeting & wealth management, decentralized banking, & NFTs.

2. What are the most trending Fintech revenue models?

Insurtech, RegTech, Digital Share Broker, Cross-border Payment, Saving & Budgeting apps, Savings, and budgeting apps, peer-to-peer lending apps, and online payment processing.