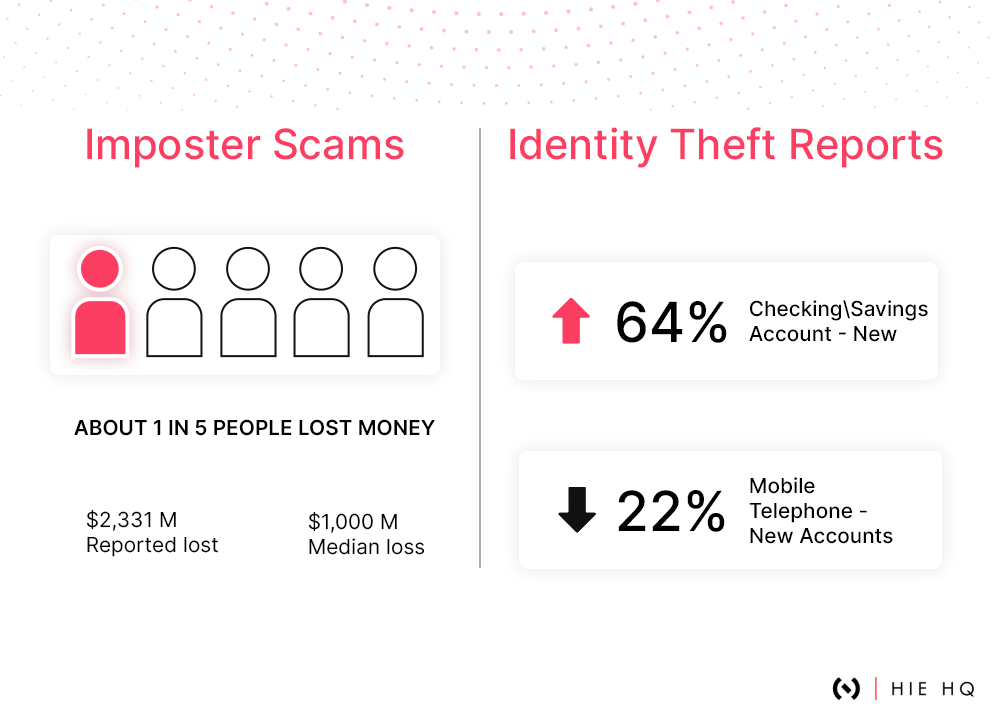

As modern technology gets along with the ingenious inspirations of our tech brainiacs, the cases of security breaches & frauds keep arising with a more disastrous impact. As per Financial Trade Commission data, over 2.8 million individuals were the victims of financial fraud in preceding years, amounting to an estimated loss of $5.8 billion which is 70% higher than the previous year. This in fact has given rise to the need of machine learning in financial fraud detection.

More & more Fintechs are facing identity thefts & transactional fraud resulting in increased demand for anti-theft tools & solutions to mitigate the potential dangers. These days, the application of Machine Learning in fraud detection is gaining traction as a popular trend among Fintech enthusiasts.

ML is changing the way banks & financial institutions strategize to strengthen their anti-theft systems such as digital identity verification setups to inhibit fraudulent activities including fake identity attempts, false insurance claims, unauthorized payments, money laundering, & other cyber threats that can cause a massive financial loss.

If we go further in detail, the scope of machine learning in fraud detection will intersect numerous use cases in the present banking & Fintech trends in future.

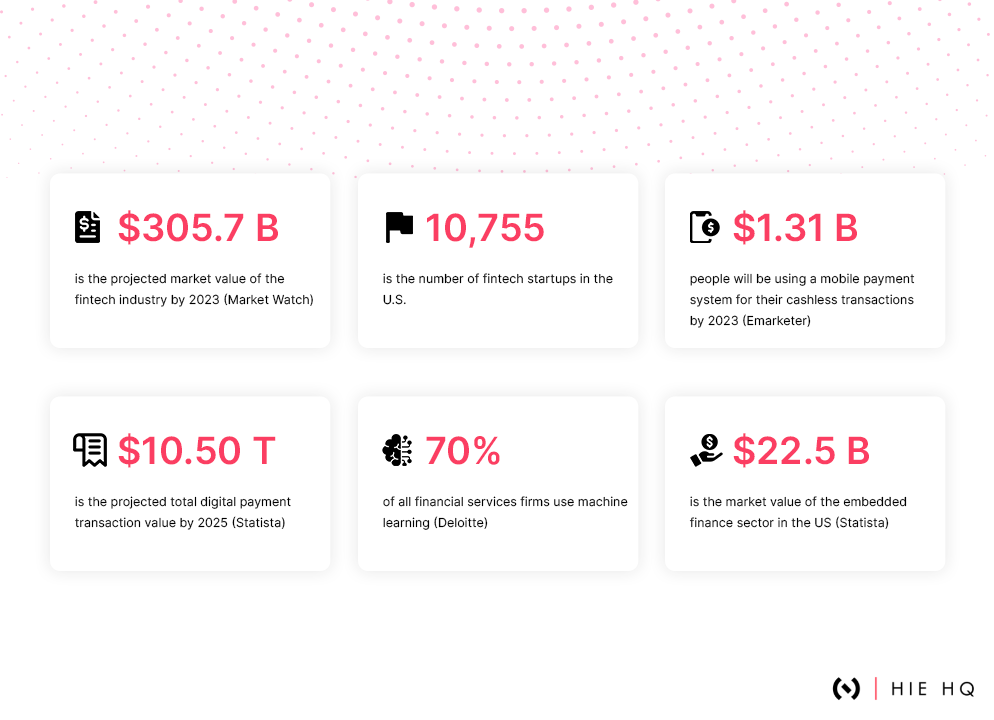

Also, read some of key statistics of fintech industry 2023.

Now let’s first give a brief on the role of machine learning in financial fraud detection.

What is Machine Learning & Fraud Detection?

Of course, you might have heard about AI & ML technologies if you’re reading this piece of information.

Machine Learning is a subset of Artificial Intelligence whereas Deep Learning is a subset of ML. And the term ‘learning’ brings a big difference in humans can use Machine Learning technology to share a huge amount of data with the computer machine that learns & interprets data for smart decision-making.

With ML, technopreneurs have gradually modified their fraud detection systems with the power of deep learning that replaced the traditional methods of restricting fraud. The old school techniques to tackle suspicious attempts & thefts have certain shortcomings as listed below:

- False positives- Getting a higher number of false positives means that you’re likely to restrict genuine customers. For instance, if your traditional false detection software blocks transactions over $500 across a blacklisted zone, then you may lose a lot of real customers too.

- Fixed outcomes- The threshold of fixed outcomes even if your average order value increases will remain the same that causing errors in tracking fraud behavior. The rules turn invalid & does not allow you to adjust the outcomes.

- Inefficiency & complexity- The rule-only approach with an accustomed fraud detection system will expand as fraud matures. It slows down the system speed that demands heavy maintenance & support from the fraud analysis team.

Now, what is fraud detection? Online fraud is a cybercrime where third-party or hackers are involved in tampering with the digital security systems to commit unauthorized fund transactions from anyone’s account. Such cases are very common in online banking that causes a loss of funds & valuable digital assets owned by Fintechs & their customers. And to identify & control such fraudulence, financial institutions use fraud detection software to ensure multi-layer security across their platforms.

Why is machine learning used for fraud detection?

1. Real-time function

Nevertheless, a longer user journey from signups to final checkouts cannot guarantee a confirmed purchase.

Machine learning in fraud detection involves a team of analysts responding to thousands of queries simultaneously.

Alongside ensuring real-time decisions, machine learning analyzes customer behavior & tracks their individual activity.

2. Highly Flexible

Any online business, particularly an eCommerce platform uses an API like Stripe as a payment gateway to enable high transaction. However, it lags when configured with a rule-only system that pressurizes rules library as the number of payments

Well, machine learning bags a point in this case, as data becomes better with ML.

By leveraging machine learning for fraud detection, Fintechs solidify the major datasets that make it more efficient to trace genuine & fraudulent users. It simply means that an ML-based model can differentiate between suspicious & authentic behaviors of customers to predict the possibilities of fraud transactions in the future.

3. Efficient & affordable

Machine learning technology works similar to hundreds of analysts keeping a record of hundreds & thousands of payments every second.

Machine Learning takes all labors of data analysis that usually takes 100s of fraud analysts when done manually. In place of humans, machine learning algorithms can perform repetitive, complex, & time-consuming tasks within a blink of an eye.

4. More Precision

The usage of machine learning in fraud detection is effective in tracking non-intuitive patterns. ML-powered systems are integrated to detect abnormal or suspicious behavior of users.

In this way, the role of machine learning in fraud detection is observed as an idea to track suspicious customers.

Suppose, you’ve got an eCommerce marketplace that connects sellers & buyers from various countries and you are using machine learning to leverage a neural network that can flag certain suspicious signals such as the number of page searches made by customers before planning an order, determine copying & pasting of information by resizing windows, reporting reviews by other customers, & more.

How does a machine learning system for fraud detection work?

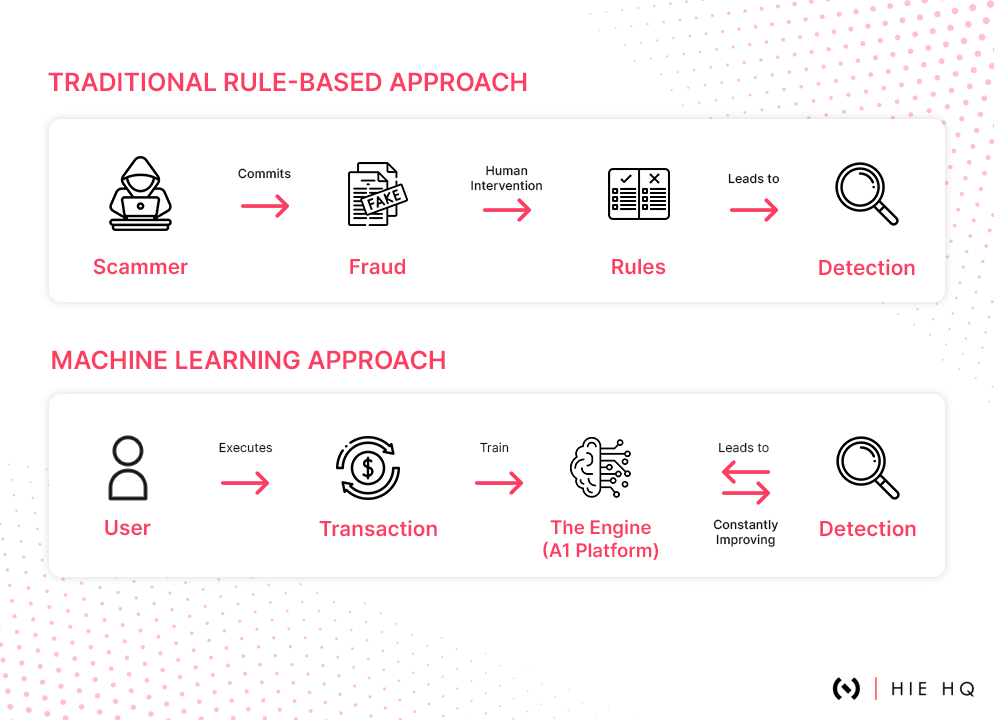

The mechanism of machine learning for fraud detection solutions is distinguishable from the traditional rule-based approach to detecting suspected fraud. The below image illustrates how the ML-driven approach uses AI & replaces rule-based methods that require human interventions to detect fraud.

Overview of using different forms of machine learning for fraud detection

1. Input data

Machine Learning needs more data & it’s better for effective fraud detection. In the case of supervised ML, the data must be categorized as good or bad.

2. Extract features

Features usually define customer behavior as well as fraudulent behaviors that are collectively referred to as fraud signals.

There are five main categories of group features, each of which has thousands of distinct features as listed below:

- Identity

No. of digits in the users’ email address, no. of active devices used by individual customers, age of their accounts, & fraud rate of users’ IP addresses.

- Orders

No. of orders placed by users in the first week, no. of failed transactions, order value, & suspicious basket contents.

- Payment modes

Fraud rate of issuing company or bank, comparison b/w customer name & billing name, and usage of international cards.

- Locations

Similarities between shipping address & billing address, shipping country similar to customer’s IIP address country, and fraud rate of a country.

- Network

No. of emails, payment modes, contact numbers shared within a network & age of the customer’s network.

3. Train algorithm

An algorithm is described as a set of rules to be followed when solving difficult issues.

A training set is scheduled to train the algorithm using the own historical data of an online seller. The machine will have more examples to learn with more fraud cases in the training set.

4. Build a model

The process of leveraging ML for fraud detection will further indulge in specifying a model to detect fraud.

Financial fraud detection using machine learning – Use cases

Implementing ML-based fraud detection setups is beneficial for Fintechs planning to secure their operations from the risks of missing fraudulent transactions, human errors, & various cases of security breaches.

Modern machine learning algorithms are designed to process massive volumes of data & safeguard it from potential frauds.

One of the primary use cases of machine learning in fraud detection appeared when a startup named compliance.ai incorporated an adaptive machine learning model in Fintech to enable research & track financial regulations along with their updates all in one place.

Another use case of machine learning for fraud detection in Fintech is observed around companies like PayPal that are using ML-powered systems to boost their fraud detection & risk management strengths.

Paypal’s risk management engine works with the combined power of linear, neural networks, and deep learning technology. It can evaluate the risk levels with every customer in just a few milliseconds.

ML empowered a vast segment of Fintechs & financial institutions to mitigate the issues of fake accounts that are also monitored by the digital identity Verification systems, suspicious transactions, and payment frauds.

Furthermore, it takes care of all efforts required to do predictive analytics & data analysis to make organizations more secure against fraud.

Secure your business with new-age AI/ML technologies

Global businesses have started leveraging data science to keep financial fraud at bay. Machine learning is emerging as the most promising & favorable technology to drop down the cases of digital fraud that may cause big losses each year.

However, with the implementation of modern Machine learning tools for fraud detection, Fintechs prefer to deploy secure & advanced solutions in their systems that are difficult for fraudsters or scammers to manipulate. At Hie HQ, we co-build industry-specific solutions for Fintechs as well as various business domains from Healthcare & Fitness, eCommerce, gaming, SaaS development, AI/ML, & other trending technologies.

Our expertise in crafting world-class digital products is driven by our startup-centric approach & ideology in shaping robust product innovations followed by ideating/brainstorming, product planning, UI/UX design, development, Q/A testing, deployment, maintenance & support.

At Hie HQ, we adhere to our client’s satisfactory efforts & go beyond our limits to meet their expectations.

We don’t just create, we co-build to deliver a product that makes a difference.

FAQs

1. How can banks use machine learning for fraud detection?

Banks leverage AI & ML-powered solutions to collect big data insights & use them to conduct predictive analytics of suspicious behavior of users. The role of machine learning for fraud detection is noted where banks are using it to prevent fake accounts, payment frauds, promotion abuse, account takeover, & any type of unauthorized transactions.

2. How machine learning improves fraud detection in corporate businesses?

Machine learning for fraud detection deals with false positives that usually happen in traditional methods of detecting fraud. It is more effective than humans in detecting non-intuitive patterns to track suspicious activity.