The amalgamation of Finance & Technology has brought a drastic change in the traditional modes of banking & investments. And it’s been a decade since financial institutions & banks are using Fintech to accelerate, automate, & secure their banking operations. Then & now, the only buzzword in the finance is fintech risk and compliance.

Perhaps, there is still a scope of developments in Fintech that will surely appear with the evolution of technologies around neo banking, payment gateways, blockchain or cryptocurrency, & more. However, the future of Fintech lies in how businesses are dealing with the risks & compliance standards.

Although Fintechs never categorize themselves as financial institutions, they can’t neglect the risks & compliance regulations at any point. Fintech is seemingly facing conflicts with how new fintech innovations & their adopters will disrupt the marketplace.

The partnerships between Fintechs & financial institutions is paving the way for banks to flourish their businesses.

An overview on Fintech risk and compliance

Today, most Fintech have recognized the appeal of partnering with established banks & financial institutions, like Revolut & other neo-banks. The collaboration with other companies can result in market exposure from their existing customer base.

On the other side of fintech risks & compliance, it empowers Fintech to make their technologies & tools available to customers . Probably banks & financial institutions are incapable of developing them on their own.

Now let’s get back to the topic & discuss how Fintech risks & compliance impact its future.

The future of Fintech is promising as predicted. But the risks & compliance may have some shortcoming to the rise of Fintech market. So, here is a brief discussion on Fintech risks & its futuristic impact.

Fintech and regulators – The new norms

The adoption of Fintech has gone to the mainstream, so its future. But the result of such an increased prominence has raised the alarms of regulators.

Banks & credit unions are more than interested to see how such regulators will impact the growth of fintech companies.

In the initial stage, regulators had no challenges dealing with Fintech as it completely differs from traditional banks. The Officer of the Comptroller of the Currency (OCC) proposed Fintech charter to empower Fintechs.

Still, most Fintechs in the developing world have distinct opinions with most of the state regulators.

For example, a Fintech company named Social Finance which is an online lending firm & also known as SoFi is one of the applicants of industrial bank charter with Federal Deposit Insurance Corporation. Aiming to become an online-only institution with no branches or ATM deposits to provide FDIC-insured checking accounts & credit card products.

However, this application attempt was greatly objected by detractors & opponents while banks & credit unions were keen to know how FDIC would be dealing with this case. This will be the only way to predict if such digital-only entrants would be able to survive in the Fintech market or not.

Fintech and bank: Risk and compliance to bring a big change

As mentioned previously, the fintech industry has always prevailed a motto saying that “we are not financial institutions.”

With almost no restrictions by compliance & regulatory requirements that are usually applied on banks & financial institutions, Fintechs maintained their standards for building better customer connections, keeping up with cross-navigational market trends, & making deep disruptions for the existing competitors.

However, the most recent progressions taking place in Fintech risks & compliance standards inspire experts to foresee these gradual transformations:

- They’re usually determined by household names & less-known upstarts.

- They’re completely recent & relatable to the regulatory action taken today, & introduced back in 2015.

- They highlight the operational, regulatory, & reputational risks that threatens the safety & credibility of banks and financial institutions.

- In addition to this, the number of actions focussed on how the customers must be treated & how they can meet regulatory protection with all sorts of Fintech products oe services they avail.

- They’re like banks but more than how they operate, far away from non-traditional channels, focusing on the pace & ease of access.

Fintech compliances & regulatory voices

As the Fintech market continues to expand, a number of innovations were pointed out in Katinas that has been changing the Lithuanian market:

Paysera, which is another low-priced, convenient payment services across all forms of technology.

There are many companies who are opting for Fintech app development.

P2P Lending, a technology providing competitive returns on investment.

In 2016, the Office of the Comptroller of the Currency (OCC) published a paper on its “vision for responsible innovation in the federal banking system.” This initiative opened the door for fintechs to continue their pursuit of growth by working collaboratively with regulators to develop solutions specific to the regulation of their product offerings.

On July 19, 2017, speaking before the Exchequer Club in Washington, DC, Keith Noreika, acting Comptroller of the Currency, expressed strong support for the responsible innovation initiative. He characterized the proposal to grant special purpose national bank charters to fintech companies as “a good idea that deserves the thorough analysis and the careful consideration [OCC is] giving it.”

Coincidently, six days after the acting comptroller’s remarks, Varo Money, a mobile-only fintech company, filed an application with the OCC for a full national bank charter and a complementary application with the Federal Deposit Insurance Corporation (FDIC) for deposit insurance.

Varo became the second fintech company to seek FDIC insurance, following Social Finance Inc. (SoFi), which filed an application with the FDIC in June to establish a Utah-chartered industrial loan corporation (ILC). SoFi’s ILC application reignited a longstanding debate about the efficacy of this type of bank charter, and the FDIC’s decision on granting new ILC charters could have major implications for the fintech industry.

Other authorities are also addressing fintech-related regulatory concerns. In June, the Financial Stability Board (FSB) published a report on the financial stability implications of fintech firms. Although the report concludes that there are “currently no compelling financial stability risks from emerging fintech innovations,” it identifies 10 supervisory and regulatory issues that “merit authorities’ attention.

Fintech risk and compliance – The future

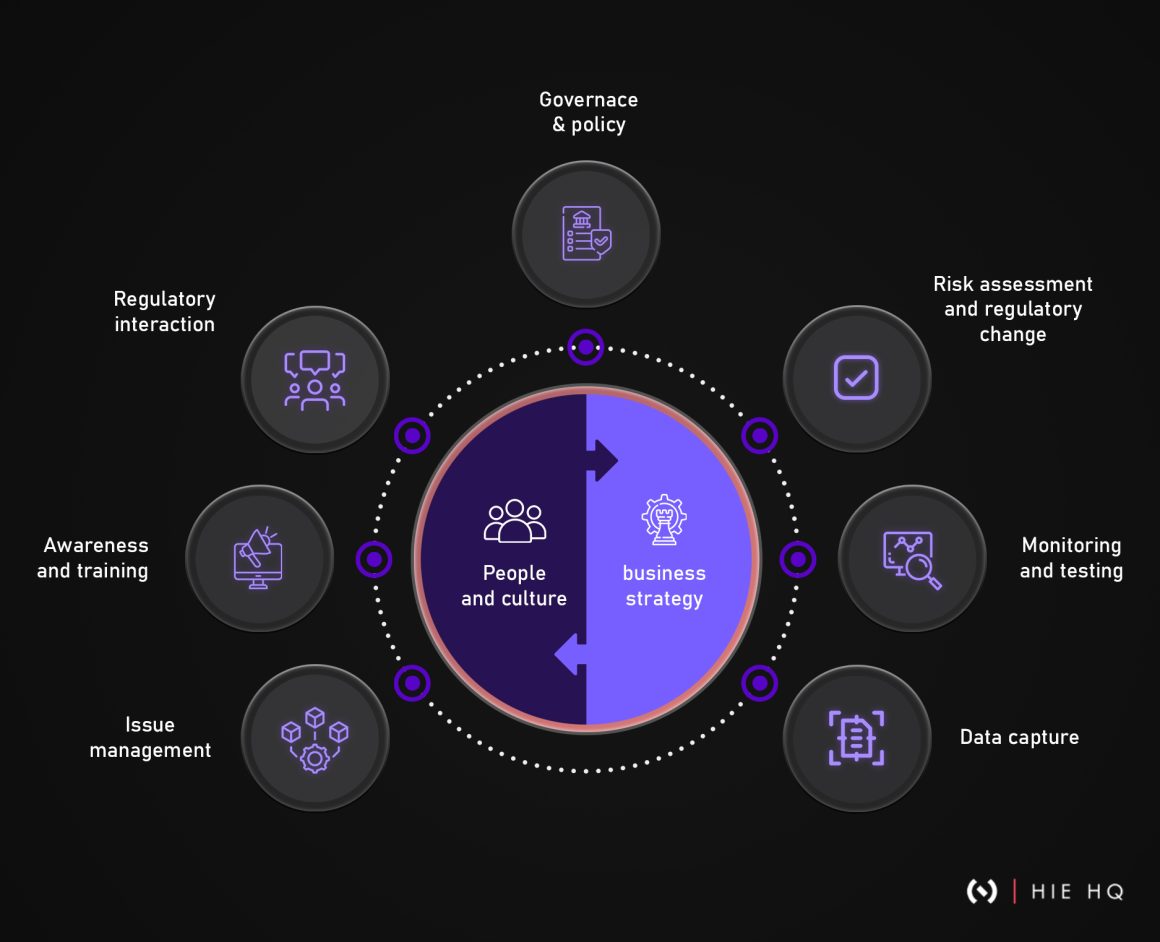

No matter what approach these fintech companies implement to regulate markets—only to emerge as a chartered institution or remaining as they are. They seem to boost the chances of achieving success with the help of solid risk management controls.

The role of regulatory & compliance in Fintech reflects the importance of better customer experience & trust for financial institutions & banks. After all, a compliant company is a much more trustworthy & credible source of investment for the public.

At the end of this discussion, we would like to redefine the trends & technologies shaping the future of Fintech, noted as blockchain, cryptocurrency, neobanking or open banking, NFTs, & more. The massive disruption of cutting-edge technologies has radically compelled the rise of Fintech startups & finance businesses emerging around. All such product innovations are the outcomes of talented tech minds at companies like Hie HQ, a leading product partner of reputed brands, co-building custom products that achieve success.

At Hie HQ, a pool of proficient product engineers bring the right set of expertise to co-build high-tech software products for clients from varied business domains. We’re acing up the game of crafting industry-specific solutions on the verge of our startup-centric approach.

FAQs

1. Why is it essential to know about fintech risk and compliance?

Fintech risk and compliance is a rapidly growing field that has the potential to impact every business. By understanding the risks and how to comply with regulations, you can protect your company from costly penalties or legal action.

Fintech risk encompasses a wide range of concerns related to financial technology, such as cybercrime, data breaches, and money laundering. Compliance mandates may include developing policies for KYC (Know Your Customer) processes, ensuring anti-money laundering measures are in place and implementing fraud prevention systems.

By fully understanding fintech risk and compliance issues, you can safeguard your business from potential harm while meeting regulatory requirements.

2. What are some of the regulatory concerns in fintech?

There are several regulatory concerns in fintech, including anti-money laundering and counterterrorist financing measures. Additionally, regulators are also concerned about the role that blockchain technology may play in the financial system. While these concerns have yet to be fully vetted, it is important for companies operating in this sector to stay up-to-date with changes and regulations to continue using safely and legally.