In today’s time, a Fintech business is destined to modernize its data systems, over data analytics, decision-making, and above. The role of Artificial Intelligence in decision analytics is widely promoted in banking, financial trading, business risk management, & more. Semrush predicts that the annual growth rate of AI between 2020 & 2027 will be more than 33.2% as 70% of businesses will use at least one type of AI technology by then.

There are no ifs and buts to believing that Artificial Intelligence is a soul of data-centric Fintechs looking forward to modernizing their business operations. From data-driven decision-making to autonomous functions, the advantage of AI & ML makes a wondrous impact on the overall productivity & quality of how procedures are done.

In this article, we will determine how AI boosts business intelligence for better decision analysis in Fintech. Embrace the power of AI to boost business intelligence with Hie HQ.

Now when the experts admit that AI is ruling across the global Fintech market, businesses are immensely driven to adapt smart AI-powered solutions to boost their decision analytics.

Over the next coming years, 3 out of 4 reputed accounting companies will plan to invest $9 billion in artificial intelligence & data analytics services & products, but why?

There are plentiful reasons to opt for AI-based setups to optimize your business intelligence, particularly if you’re a startup looking for a comprehensive guide to getting started with Fintech app development.

What is AI-driven decision analytics?

The world calls for Artificial Intelligence to bring more innovations into the Fintech techno space.

As per a Forbes report, 83% of organizations have raised their AI & machine learning budgets since 2019.

It’s not just cybersecurity, fraud detection, digital verification, or compliance, the urge for smart, robust, & automated systems to draw precise analytical decisions is a key factor behind the craze for AI in decision analytics.

AI is everywhere as it continues to streamline & optimize our processes with these competitive advantages:

- To make more data-centered decisions for the business.

- To automate complex & repetitive tasks using that might take more effort, resources, & time when done manually.

- To generate higher revenues through direct targeting & accurate recommendations.

- To lower churn by tracking hesitating or customers not intending to make an upfront purchase.

Perks of AI

The perks of AI in decision analytics are exceptional & they’re unavoidable for any Fintech business.

When it comes to decision-making, Fintechs make the most out of Artificial Intelligence to quickly collect data or stats from diverse sources to make smart & profit-driven decisions for their business.

Most finance startups & 86% of bank CEOs reported that AI will remain a mainstream technology in the coming time.

Well, we can’t predict everything about AI but yes, it holds massive opportunities to capture all-around data more effectively than humans.

Any Fintech organization shall need to deploy resources including technology, physical assets. for instance, hardware equipment & software, & human workforce to operate the process at a rocket speed.

In such a scenario, AI fuels decision analytics by choosing each operational action independently. From consistently drafting precise digital information, consumption, & final implementation of changes, AI takes care of everything.

Nowadays, AI technologies can independently run a manufacturing line besides considering human intervention as an option for efforts needed in many cases. No doubt, technology has revolutionized the way businesses used to operate with human involvement.

Financial Use Cases of AI-Driven Decision Intelligence

It’s challenging to implement smart analytics for most Fintech firms. But companies who use AI to drive their decision intelligence get great outcomes with varied benefits. Let’s see how modern financial institutions are using AI these days.

1. Assets Management & Investments

AI sees diverse opportunities for advanced decision intelligence in these particular areas. Hence, the most prominent use cases for AI in decision analytics for assets management & investments include:

- All sorts of weather predictions, online company sentiments, live media coverage, & other insights used to generate investment decisions can be analyzed to shape hedging strategies.

- Real-time access to automatically generated insights on individual customers’ portfolios.

- Smart methodology to ensure targeted client outreach on their recent & in-person search patterns or behavior.

One amazing example of how AI boosts business intelligence for better decisions is observed on Morgan Stanley WealthDesk.

It is a platform that widens its client analysis approach to share real-time data & recommendations for various investment strategies.

2. Secure & Seamless Payments

Decision analytics is a core function of any banking or online trading apps like Robinhood, ensuring multi-layer payment security for banks & their customers. Also, they’ve replaced outdated rule-based systems that are less secure & effective in fraud detection. It helps in preventing cybersecurity risks & strengthening customer relationships.

More than 73% of online shoppers with an annual income of around $800,000 to $999,999 had experienced card declined transactions at least once a while shopping online. This belongs to the 30% average of all customer segments. And banks had to suffer in such a scenario.

The use of AI in decision analytics can help you keep up with financial security as well as customer experiences.

Let’s take an example of Mastercard’s Decision Intelligence solution that uses a machine learning algorithm to read customers’ debit card & credit card data to further analyze the data points related to each transaction & determine whether it’s authentic or suspicious.

To understand how AI boosts business intelligence, you must note this use case of machine learning in intelligent decision-making against security threats.

Such models can perform automated analysis of large transactions including cross-border transfers to prevent fraudulent activities & speed up the overall in-process funds’ clearance.

The traditional “three-day funds model” is no more effective against cybersecurity breaches.

3. Retail Banking

We already know how Fintech is transforming the banking sector at a high pace. The role of advanced analytics benefits retail banks as far as the increased competition from digital banks is taken into account. Below are some crucial value opportunities of AI in retail banking:

- A renowned bank in the US implemented machine learning algorithms to track the discounts offered by their private bankers to the customers. They found that their bankers are providing unnecessary discounts to most of their customers & hence, they made changes to their pricing strategy by modifying their discounts & offers according to their users’ needs & banks profits.

- Lloyds Banking Group used data-driven product marketing upon leveraging AI for decision analytics that generated over 24% of new leads across its group-wide analytical ecosystem. It encouraged the bank to promote their products in a more targeted way, with higher precision & at ideal pricing.

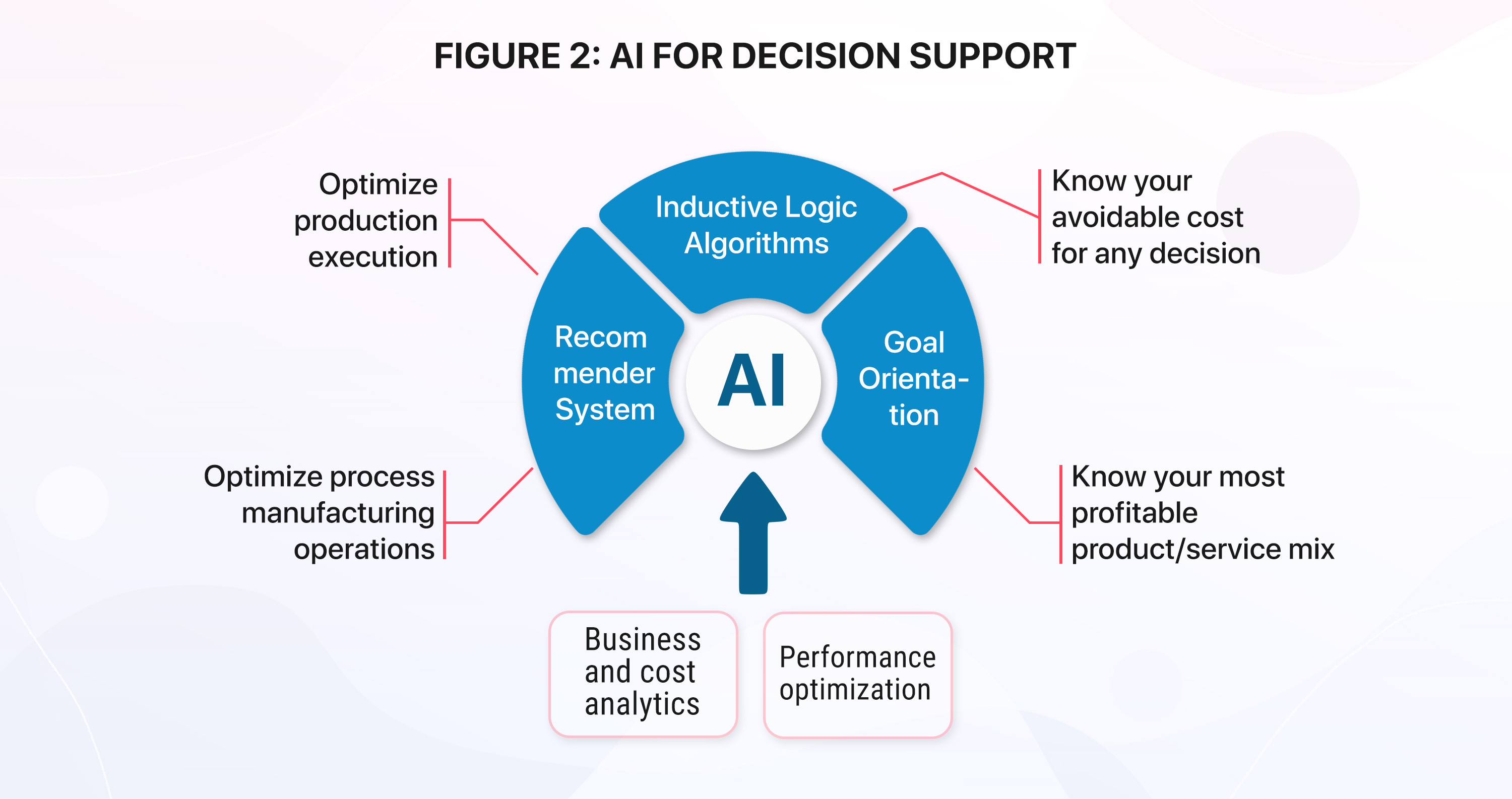

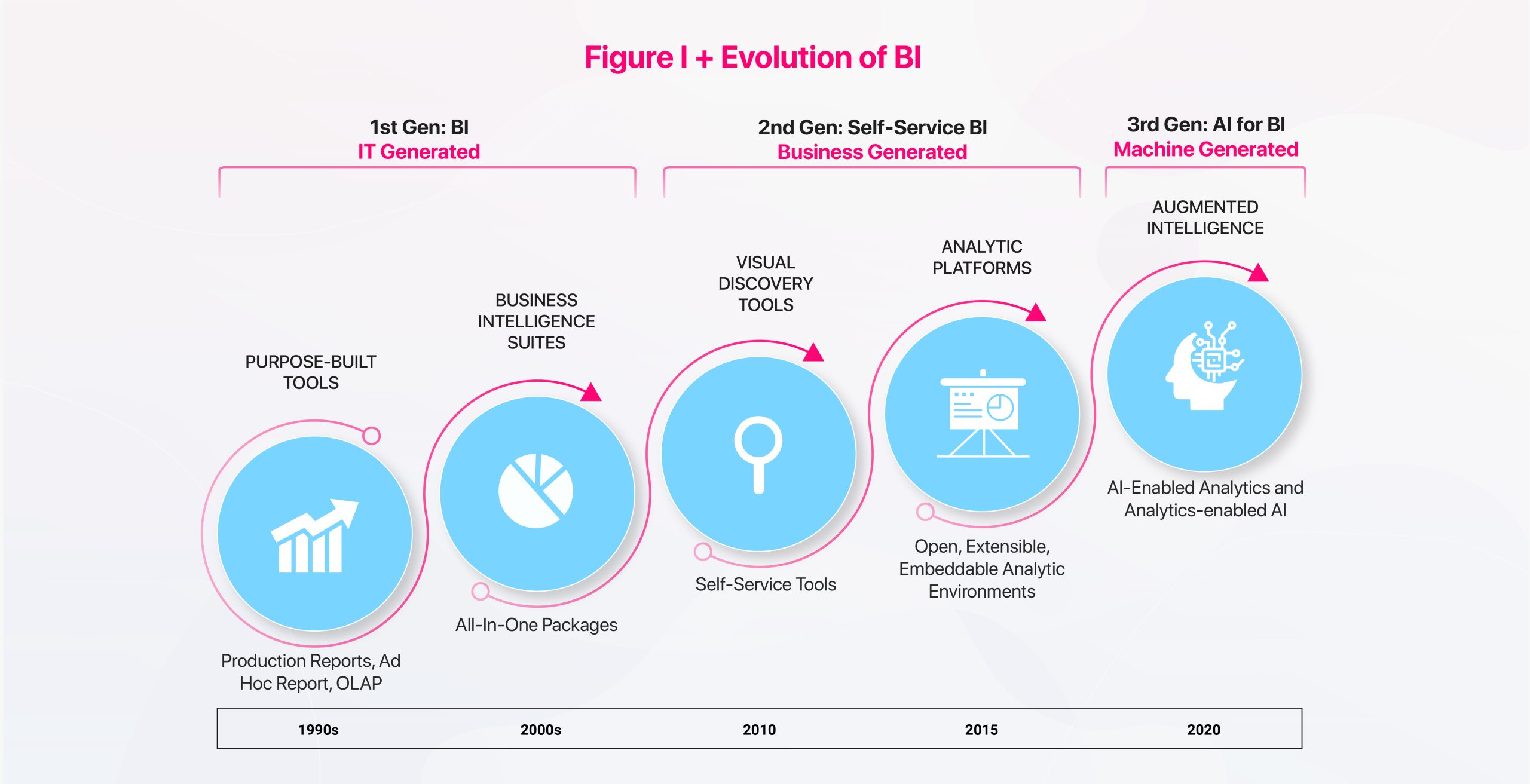

How Can AI Help Business Intelligence Applications?

AI boosts BI (Business intelligence) for advanced decision analytics. BI, which is related to smart & automated ways of accessing, processing, & analyzing tons of data has become a need of the hour for Fintechs. Not only financial institutions, but many research & analytics companies like Tableau, Zoho Analytics, and Datapine are also using modern business tools to boost their operations.

When it comes to business intelligence, there are various issues that appear with its process that alter the system’s performance. Let’s see AI can deal with such issues:

1. AI upscales business intelligence functions

The quality of a business intelligence solution can be defined when a massive amount of data is segmented into granular insights. It empowers businesses to ponder over the finer points of a clear picture.

Although AI boosts business intelligence apps’ capacity & functionality, real issues or errors may arise in real-time insight.

Business intelligence is meant to process & visualize data but it fails to generate data results & trend predictions precisely in real-time. The combination of top trending technologies such as Artificial Intelligence/ Machine Learning & BI can generate real-time insights and trends.

Giving a boost to BI functionality via an AI-driven solution will add value to your organization.

2. AI can fill the system Gaps

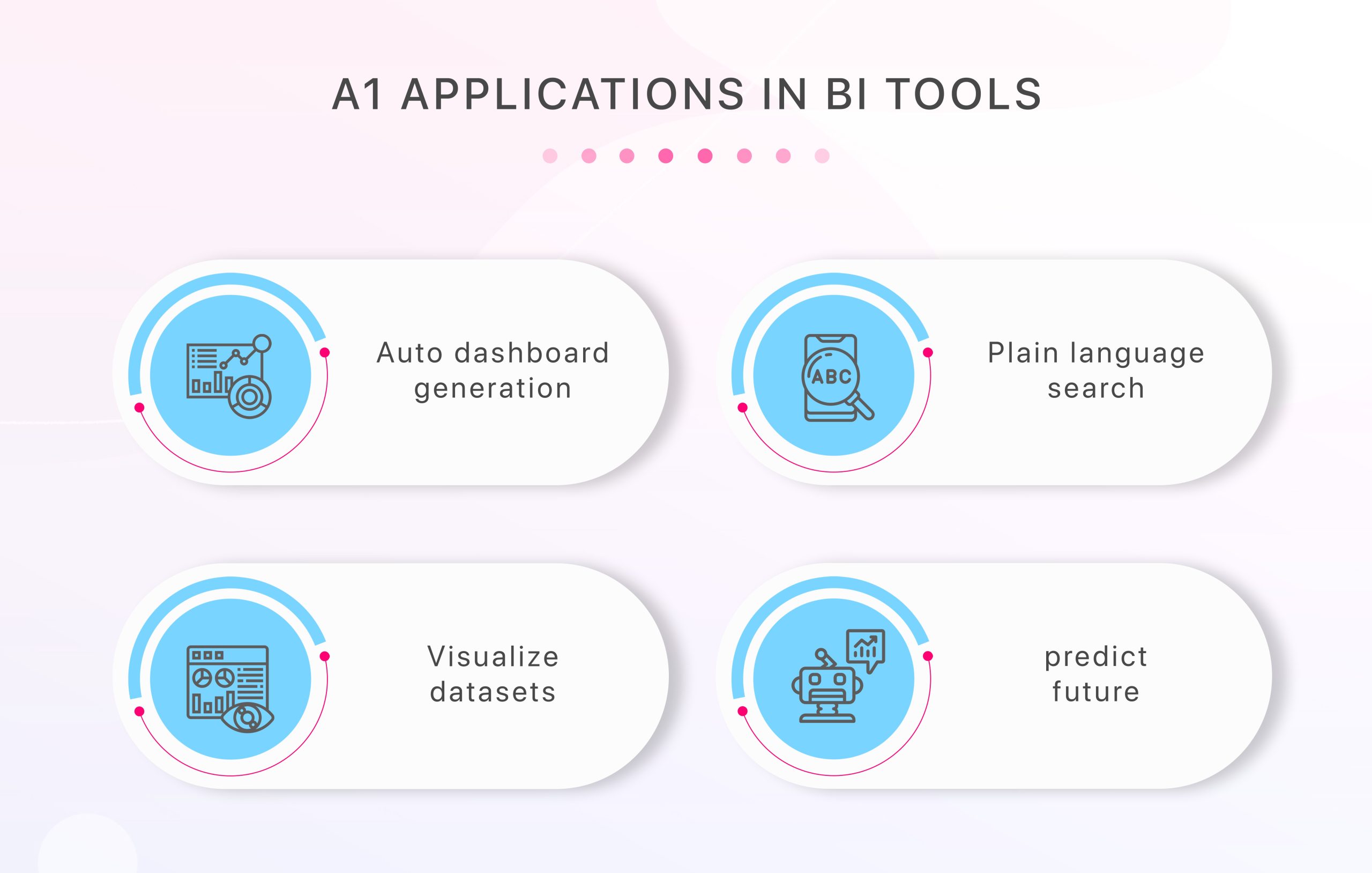

Another benefit to seeing how AI boosts business intelligence is access to business-critical insights into the data or information they can’t examine manually. The integration of AI in business intelligence helps businesses to process new data & determine emerging trends.

Natural language processing, predictive analytics, & advanced machine learning solutions are significant examples of cutting-edge technologies that are used to deliver valuable data & insights for businesses. However, AI not only delivers solutions to visualize data & analyze trends but it also acts as a tool to bridge the gap between systems.

3. AI Simplifies Complex Processes

Data surveying remains a difficult solution even if you’re using business intelligence tools. AI uses deep learning to make this process easier & faster when compared with professional data analysts.

In fact, AI combines machine learning & natural language processing to let you understand human language & simplify data analytics to discover connections & insights for businesses. Machine Learning allows you to integrate AI-enabled business intelligence to access, manage, & process huge amounts of structured and unstructured data.

4. AI Reduces Talent Storage Issues

BI is all about collecting data findings from various sources & in visual formats. These visual representations are challenging for anyone to understand. AI-powered business intelligence systems allow you to define, scale, & visualize data at the most basic level so that you can draw actionable insights to benefit your business.

In addition to this, AI plays a major role in business intelligence by eliminating major talent issues that keep altering the processes.

Being a new Fintech business needing a suitable software processing product, you must approach the right software or mobile app development company for your startup, having expertise in building AI-driven solutions to minimize the issues caused by talent shortage.

Embrace the power of AI to boost business intelligence with Hie HQ

Companies investing in full-fledged Fintech app development must strategize to use AI to boost business intelligence, in order to get humans out of the way to access, manage, & analyze valuable data for smart decision making.

It’s high time to quit data-driven workflows & adapt AI-powered workflows to make the next step to business success. Incorporating AI as your decision analytics tool will let you overcome the human limitations around cognitive bias & low productivity. Using AI will delegate data processing to high-tech machines or software that can generate decision-centered insights based on culture, value, judgment, context, & other aspects of business decision-making.

Now concluding with a clear picture of how AI boosts business intelligence for smart decision analytics, we can say that the future of Artificial Intelligence in Fintech will bring more tech innovations for new-genre financial institutions.

How can Hie HQ help?

Discover your way to mark your digital success with Hie HQ, a world-leading product partner, co-building innovative products for a wide spectrum of industries & business domains.

Our industry-specific solutions are powered by the latest technologies & tools to meet the up-to-date tech trends & standards. Hence, we go ahead with a startup-centric approach to craft top-grade products for new businesses, SMEs, & growing companies.

We provide expertise in product planning, product development, product transformation, & business transformation, covering all sorts of UI/UX designing, development, testing, support & maintenance from our dedicated product engineers.

Let’s co-build!

Contact us today & visit our portfolio to see our latest work!

FAQs

1. What are the three types of AI in business intelligence?

There are three major types of AI that are popular among Fintechs:

- Artificial Narrow Intelligence (ANI): The most preferred AI type in the market now. ANI resolves a single problem and runs only one task to satisfaction and product suggestion for a particular shopper.

- Artificial General Intelligence (AGI): A form of artificial intelligence that mimics human reasons, still only a theoretical concept to date.

- Artificial Super Intelligence (ASI): ASI is the stuff of movies involving highly complex and logical artificial intelligence. Moreover, it has the ability to build emotional relationships.

2. What is the future of AI?

AI continues to advance. Companies such as IBM and Google are paving the way for the future of AI. IBM has recently made headway by enhancing natural language processing to enhance their AI platform, Watson.

3. Who has the most advanced AI?

New Zealand recently owned the most advanced AI system in the world in April 2021 at the University of Waikato. The installation follows a pledge by the country to become a world leader in AI research and development.