The market size of Fintech’s digital transformation is set to reach beyond the $29.97 billion mark by the end of 2025 & at a CAGR of 60% in the annual forecast period. This statistics clearly provide the evidence of digital transformation for fintech.

It’s not much surprise that the intense adoption of digital transformation trends has dispersed a drastic evolution. The concept of digitalized financing has now become a new normal for banks, financial institutions, insurance.

The Global Banking & Finance Sector (BFS) sector has been thriving with a significant impact of pandemic disruption. Prior that, the BFS industry was undergoing a major transformation along with the arrival of new entrants & the rapid variations in customer expectations. Being a newbie to starting your journey as a Fintech startup, you seriously deserve to know how the impact of digital transformation is influencing the coming future of the Financial sector. Let’s go ahead!

If we go with the facts, a Fintech Barometer by Onguard reveals that the percentage of organizations planning to implement a digital transformation strategy has reportedly increased from 17% to 35% b/w a period of 2019-2021. It’s not just one, some countless facts & figures will excite your curiosity to determine how Fintech is transforming the banking & finance industry with treasures of digital transformation.

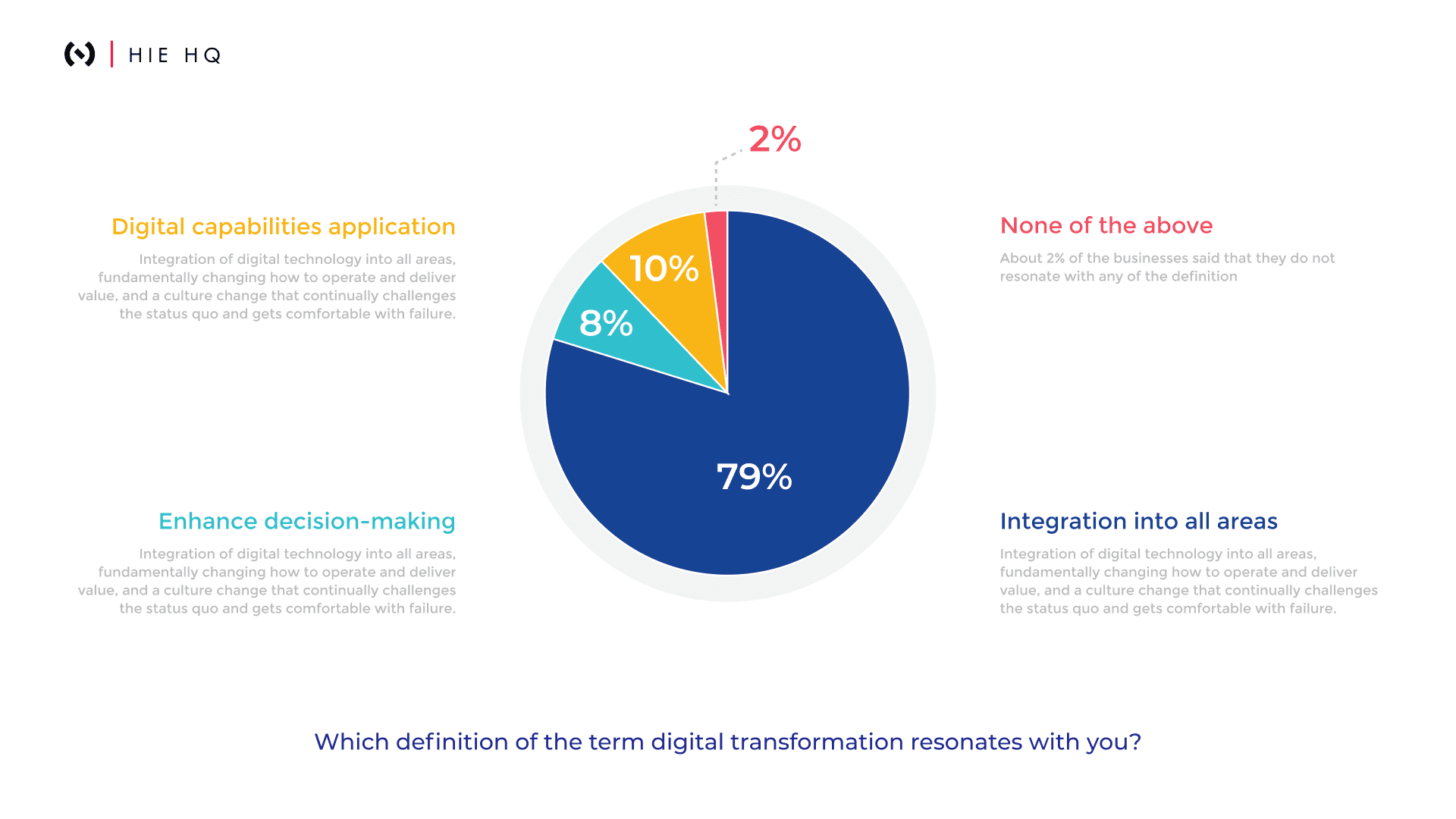

Before getting back to the topic, let’s first understand what exactly digital transformation means.

What’s digital transformation, exactly?

Digital transformation is more than just a phenomenon that brings a modern & next-gen upgrade to the ongoing tech innovations & trends. From startups to top leading industrialists, almost every business entity has touched the realm of digital transformation to optimize the way they operate.

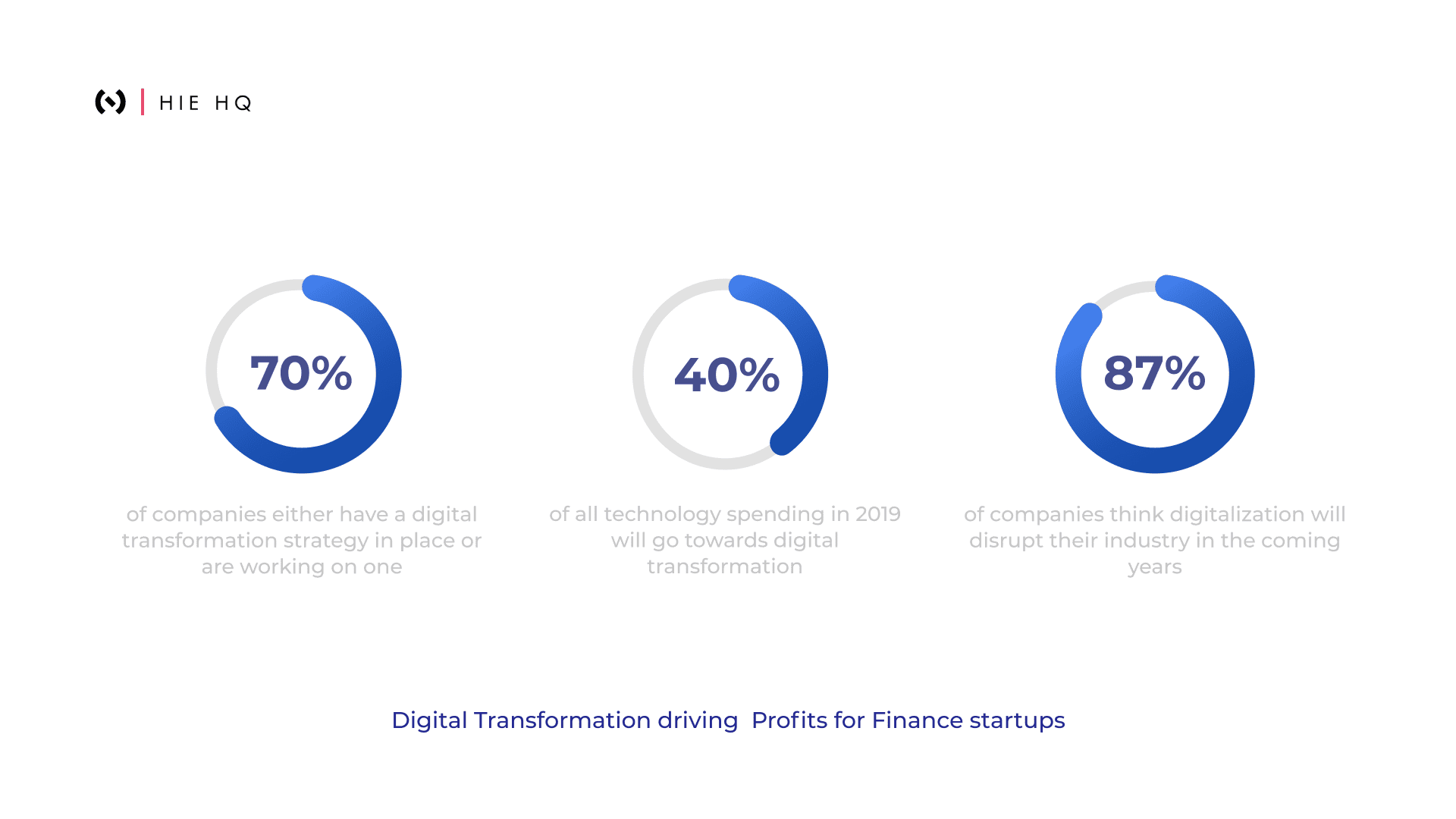

Talking about how digital transformation is reshaping the future of Fintech, we’ve got a series of facts & figures to mention.

Let’s check them out!

Quick stats on how digital transformation is affecting the future of the fintech

A study reveals the range of digital transformation adoption within a company indicates its evolution as a Fintech. In fact disruption in Fintech.

Digital transformation has become the new normal!

It’s set to make its impact so like top technology trends that will transform the future of Fintech in 2022. Here are more stats to favor the effects of digital transformation across diverse segments of the Fintech industry:

- Around 53% of organizations in the Netherlands are dedicated to undergoing digital transformation whereas over 10% are planning to start in the next six months. And the remaining 4% will initiate it in the coming one to two years.

- The pace of digital transformation adoption is comparatively slower in the UK. Only 24% of companies are on it. Less than 35% are planning to process it in the coming six months and 24% in the next one or two years.

- Over 47% of organizations adopt at least three trending technologies including Artificial Intelligence or Machine Learning, Blockchain, and IoT, which is 18% higher.

- Data analysis remained the first priority for the majority of Fintech startups. The demand for finance data automation & smart data analytics has significantly grown from 37% in 2020 to 44% in 2021.

There are countless figures stating the fortunate impact of digital transformation on Fintech. Upon noting them, you must be curious to know how exactly digital transformation can profit Fintech’s, right? Step into the next section to get your answer.

How is Digital Transformation driving Profits for Finance startups?

Digital transformation has brought ample business opportunities for banks & finance institutions. Nevertheless, now customers have other online mediums to avail a variety of banking facilities along with the availability of traditional banks & insurance service providers.

It’s not just for the convenience of customers, digital transformation in Fintech has shaped a broader scope of profits for businesses involved in it. Let’s check out some of the notable advantages digital transformation brings for Fintech newbies & emerging Finance startups:

More convenience & increased flexibility

One major perk of digital transformation is the high level of ease & flexibility it brings for Fintechs. While traditional banks & financial service providers are limited to old-world methods of facilitating their customers that inhibit their growth, fortunately, the digital transformation made it possible for Fintechs to upscale their customer experience with higher scalability & convenience.

By leveraging highly advanced & user-friendly digital tools into your system, you can accelerate your business operations, just like how conversational AI works to boost customer experience. Eventually, digital transformation gives a competitive advantage to Fintechs that become more capable of enhancing their customer experience by embracing seamless & flexible business automation.

Highly Efficient & Streamlined business

The amalgamation of the most trending digital tools & technologies brings a brilliant advantage of digital technologies to Fintech’s.

Just like Blockchain technology is transforming the insurance sector, Artificial Intelligence, data analytics, Internet of Things i.e IoT, open banking like Revolut, NFTs, DeFi, & automation have defined a new age of online financing for Fintechs and their customers.

Such technologies are the results of massive digital transformation which is now heading to shape the future of Fintech. Well, the advantage of smart data analytics, real-time reporting, and ultra-conversational systems have changed the way banks & finance institutions operate.

For example, KYC is a part of digital identity verification software used by banks & modern Fintechs. With the integration of aforesaid new-age technologies, banks not only ensure data accuracy but also the convenience of customers.

Thanks to the impact of digital transformation in banking allow companies to apply video-based & highly secure customer identity methods. And in this way, businesses can make more accurate decisions & eliminate fraudulent transactions on the basis of customer behavior or online activity.

Seamless & secure business processes

Getting a securer, faster, & simpler system is a need of the hour for every Fintech. An expert’s guide to Fintech app development at Hie HQ underlines the critical benefit of digital transformation for Fintechs that are using ultra-advanced technologies to deal with security breaches & related issues.

Modern Fintech solutions go well beyond security compliance & risk management to keep their processes secure, efficient, customer-centric, & more engaging.

Enhanced teamwork & collaboration

Digital transformation leads to enhanced collaboration within a Fintech team. There is no doubt that teamwork is a crucial aspect of financial procedures that can be easily achieved with digital transformation.

The incorporation of advanced tools & technologies helps Fintechs by streamlining their work processes to further come up with a well-collaborated & highly productive team for internal operations. This eventually results in speedy business success.

Offering more advanced digital facilities

The future of Fintech has always been procured with the rapid adoption of digital transformation. Now banks & financial institutions are more opportune to offer value-added digital services to their customers

The demand for Robinhood like stock trading app development, NFT platforms, & open banking software solutions gives solid evidence of how digital transformation is bridging the gaps b/w banking & financial services. Now customers can rely on secure, fast, & convenient access to their digital banking facilities such as credit card transactions, stock trading & investments, insurance services, digital wallets & payments, smart expense trackers, & diverse innovative tools.

Needless to say, digital transformation has paved the way for Fintechs to boost its financial operations & yield the most out of the benefits it offers.

How Hie HQ embarks on digital transformation for your Fintech success?

As far as the future of Fintech is foreseen today, AI is next to join the race of the Fintech revolution after blockchain technology. Now fintech professionals seemed to be more resistant to transforming & adopt digital transformation strategies than in earlier times. The issues with lack of data security & adequate tech skills raise major obstacles for businesses emerging in the Fintech segment. So, what’s the solution?

Hie HQ is pioneering the concepts of shaping product innovations for Fintech & Financial institutions & a wide spectrum of startups, SMEs, and big brands from industries like Healthcare and fitness, SaaS-based products, eCommerce, Gaming, & more.

We don’t just innovate products, we co-build them with our clients to ensure their feasibility & superiority to withstand the market competition. Our expertise marks our key service offering that includes product planning, UI/UX design, web & mobile app development, backend development, DevOps, quality testing, security & compliance, and support & maintenance.

Interested to transform your product idea? Contact us today. We’re excited to know your inspiration. Take a look at our portfolio to see our featured projects from our leading clients.

FAQs

1. Which ones are the challenges of digital transformation in financial services?

The following are major digital transformation challenges for Fintech startups:

- Legacy systems: Shifting from legacy to new technological infrastructure and digital expertise requires huge investments and transition costs

- Security and compliance

- Customer expectation on user experience (UX)

- Workplace culture and reskilling workforce

- Competition

2. How is AI transforming the future of fintech?

One of the top benefits FinTech companies get from AI is predictive analytics. It has applications in various domains. It helps stock traders make decisions by predicting fluctuations in the market. AI and ML help service providers nurture leads and convert them into customers.