If one technology is staggering to ground zero of the fintech landscape, it could be Artificial Intelligence. The role of AI in finance is indisputably true as observed with the agitation of the tech revolution in the banking & financial sector.

It’s undeniable that AI has pioneered the transformation of the ways financial institutions. From chatbot assistants to task automation, identity verification, fraud detection, & customer onboarding, the disruption of AI in finance is a path-breaking phenomenon that is worth your interest.

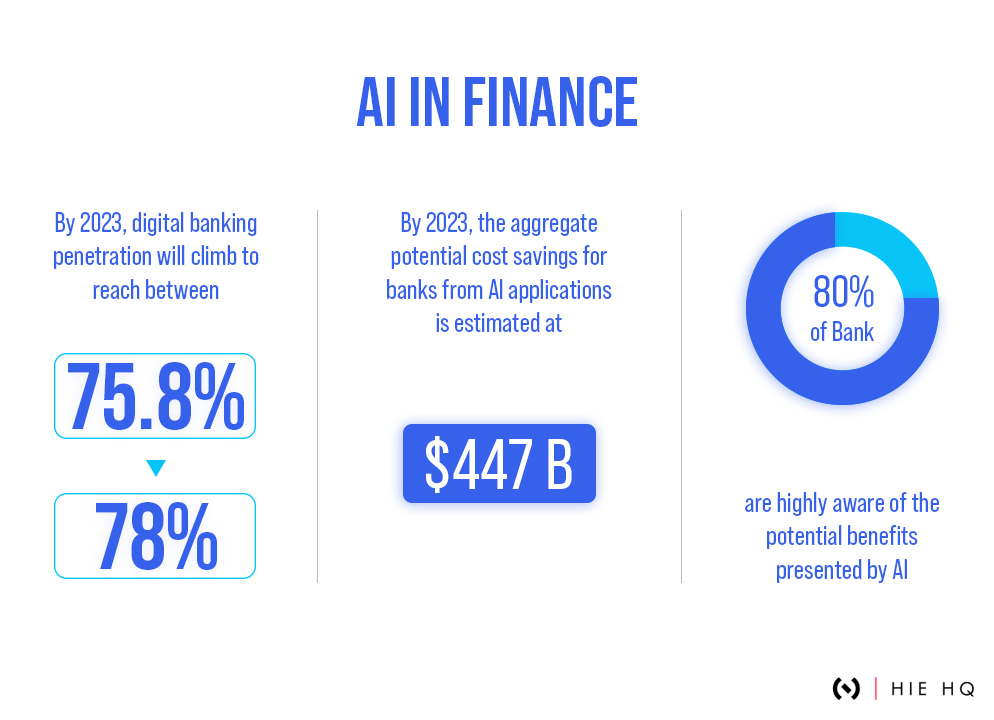

Experts are predicting that AI applications shall induce cost savings for banks at an aggregate amount of $447 billion by 2024.

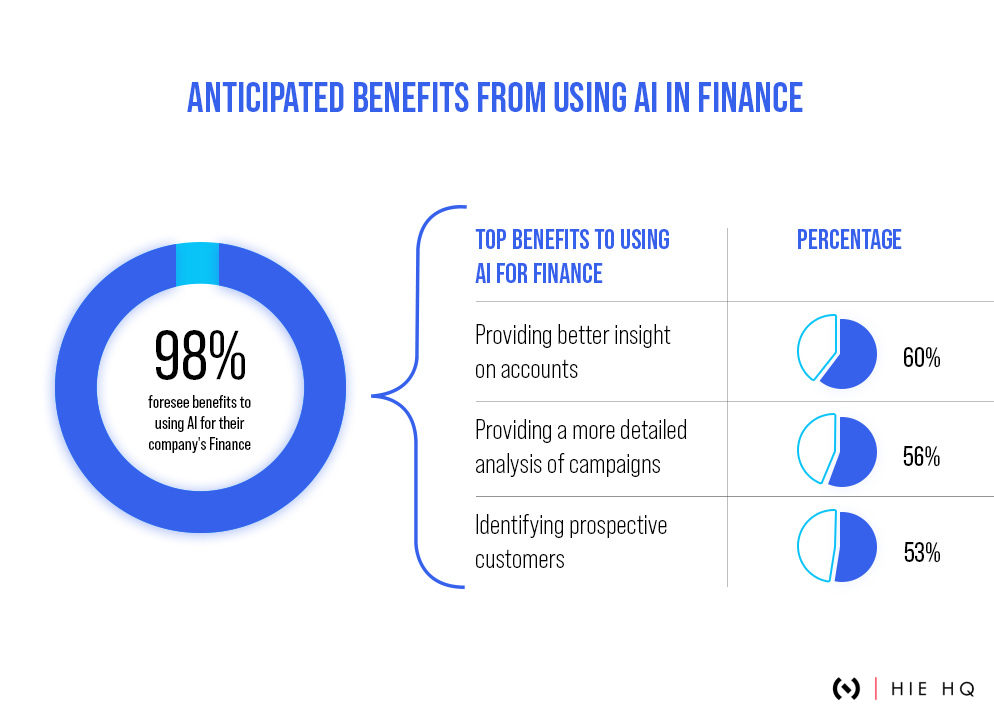

Moreover, almost 80% of banks are integrating AI into their system, knowing the benefits of using Artificial Intelligence. Machine Learning can enhance operations, as per Insider Intelligence’s AI in banking report.

Now you must be yearning to know more about AI in finance, isn’t it? If you’re a Fintech startup & aspiring to invest in AI development for your business then you’ve landed on the right page.

This article will highlight major AI uses cases in finance in the first section.

Top Use Cases of AI in Finance

There should be no ifs and buts with the benefits of AI in finance. In fact, the decision for financial institutions (FIs) to leverage AI will be driven by technological developments. With AI, now banks are more opportune to simplify the complex processes & enhance overall customer experience with 24*7 access.

No matter if your business demands automated real-time fraud prevention setup, AI is now used as a building block.

Now check out the most AI use cases in finance.

1. AI for Credit Decisions

Financial institutions & banks use AI in finance to let their customers make precise, better-informed & data-driven decisions.

The power of AI helps businesses to conduct accurate credit scoring, which is more complex & ultra sophisticated than traditional methods. It helps lenders to identify high-default risk applicants & go ahead with only credit-worthy borrowers.

Counting on the AI-powered mechanism means unbiased & accurate credit scoring used by the majority of digital banks & loan issuing agencies.

For evidence, a leading automobile lending company reported success with AI-powered solutions knowing that AI reduces losses by 23% annually.

2. AI and Risk Management

The impact of AI in finance cannot be overshadowed in areas of risk management.

AI’s processing power allows businesses to store & handle a huge amount of business-critical data in a short time along with the benefits of cognitive computing that helps to handle both structured and unstructured data simultaneously. And for your information, this ain’t gonna be an easy-going task for humans.

Such AI-based algorithms analyze the history of certain risk cases & identify early signs of potential future issues in the context of financial loss.

This AI use case in finance is rewarding when it’s about keeping an eye on the real-time market updates. You can come up with accurate predictions & well-detailed forecasts to pose your financial plans.

Just like Crest Financial, a US leasing company used AI in finance with AWS & recorded a noticeable improvement in their risk management. Know more about cloud computing & platforms like AWS, Microsoft Azure, Google Cloud, etc. to learn how they work.

3. AI and Fraud Prevention

The role of Artificial Intelligence in finance is a huge topic of discussion.

AI in combination with Machine learning for fraud detection is the best way to counter the risks of financial fraud.

But how exactly do these fraud detection systems work? Well, they analyze client’s behavior, account actions, locations, habits, & responses to a security process that works on a mechanism.

Also, banks deploy AI solutions to track down one more illegal activity or a financial crime i.e money laundering.

The advanced AI-driven machines identify suspicious activities to further cut down the costs of investigations. A study revealed 20% reduction in expenses due to artificial intelligence & digital identity verification.

Not just in finance, AI brought a big relief for eCommerce businesses that are involved in high-volume card transactions.

4. AI and stock trading

The concept of data-driven investments has gained traction over the last 5 years & made trillion dollars in 2018.

It’s a kind of algorithm-based, highly quantitative, or high-frequency type of trading. This type of stock trading platform like Robinhood is developed to simplify trading for investors. And Artificial Intelligence plays a big role in it.

As a real-world example, a business news company named Bloomberg recently introduced its Alpaca Forecast AI Prediction matrix which works as a price-forecasting app for investors using AI. It gathers data from market insights as shared by Bloomberg, & combines it with advanced learning algorithms to further read & analyze share market patterns & price movements.

Here is how AI & online trading work to improve the user experience:

- Intelligent Trading Systems powered by AI are used to monitor structured data like spreadsheets, databases & unstructured data such as news, social media, etc. in a blink of an eye.

- Since time matters more than anything in the stock market & trading world, AI machines ensure faster processing of stock data to let investors make faster decisions.

- The algorithms based on AI are capable of sharing accurate & faster predictions for stock performance. Its advanced trading systems use past data records to validate the process & come up with truly precise prediction reports.

- AI in finance & trading shares recommendations with the most impactful portfolios of investors who’re more determined to achieve long & short-term goals.

5. AI and Personalized Banking

Banks & their customers won’t have to depend on physical modes of managing their banking needs as AI-powered smart chatbots have replaced human intervention in the process.

These chatbots provide self-help options, reducing the workload on call centers. If we talk about voice-controlled virtual assistants powered by tech giants like Amazon’s Alexa & Apple’s Siri, their use cases are observed in finance, where self-education is turning easy & accessible with user-friendly banking tools for a payment schedule, balance checks, fund transfers, & more account activities.

At present, the abrupt demand for dedicated Fintech app development service providers is high among banks & financial institutions. Why?

The reason is more inclination of customers towards personalized banking & financial advice. Such Fintech apps use AI to integrate intelligent systems for income tracking, spending behavior, and recurring expenses, and coming up with personalized plans and financial tips.

A few reputed US banks including Wells Fargo, Chase, & Bank of America have recently launched their own mobile banking apps to make banking simple, convenient, secure, & fast for their customers.

6. AI and Process Automation

The process of robotic automation is on the minds of the global industry leaders, particularly when they want to cut down operational costs & boost productivity.

Intelligent character recognition makes it easy to automate a series of tasks that are time-consuming & complex. Instead of spending thousands of hours & effort, AI-enabled software automatically verifies data & generates reports digitally as per the given parameters, reviews documents, and extracts information from forms (applications, agreements, etc.).

Employing robotic process automation for high-frequency repetitive tasks eliminates the room for human error and allows a financial institution to refocus workforce efforts on processes that require human involvement. Ernst & Young has reported a 50%-70% cost reduction for these kinds of tasks, and Forbes calls it a “Gateway Drug To Digital Transformation”.

A leading financial firm, JP Morgan Chase, has been successfully leveraging Robotic Process Automation (RPA) for a while now to perform tasks such as extracting data, complying with Know Your Customer regulations, and capturing documents. RPA is one of ‘the five emerging technologies‘ JP Morgan Chase uses to enhance the cash management process.

End note:

The implementation of AI in finance is the need of the hour for banks & financial institutions.

As the world moves on the progressive stage of Fintech development, technologies like Artificial Intelligence, blockchain, cloud computing, data science, etc. will uncover more of their use cases, efficiency, & standardizations with end-to-end pipelines to their powerful capabilities.

However, if you’re desirous to achieve full-scale automation, it won’t be so easy to achieve as you always need brilliant minds to innovate products that go well beyond your expectations.

Whether you’re a Fintech startup or a brand from other business domains, we at Hie HQ are the best product partner to scale your business exponentially. We leverage our award-winning specialization, startup-centric approach, and co-build ecosystem to co-build custom products for varied industry niches. Our expertise revolves around Fintech, Healthcare, Social & community, and next-gen technologies including NFT, blockchain, AI/ML, IoT, BLE, & more.

FAQs

1. What are the ethical challenges of AI in finance?

As machines increasingly become better at making investment decisions, there are several challenges down the line. For example, should financial institutions be able to use AI to make decisions about which products and services to offer their customers? If so, what is the right level of disclosure for these algorithms? And finally, what are the implications of artificial intelligence becoming more intelligent than human beings at developing and managing financial portfolios?

These are just a few examples – as AI evolves and gets better at investing money. We must continue discussing these issues openly and develop solutions that strike an appropriate balance between humans and robots in finance.

2. Does AI impact financial customer privacy?

There is a lot of debate surrounding the potential impact that artificial intelligence (AI) has on financial customer privacy. While some argue that AI will negatively impact consumer privacy, others believe it could be beneficial in the long run.

One argument against AI impacting financial customer privacy is how machines can quickly identify patterns. It could lead companies to collect more personal information about customers without their consent or knowledge, violating their rights.

On the other hand, proponents of AI argue that it can help banks and other businesses better understand individual spending habits by spotting common behaviours and factors across different accounts. It allows them to develop more innovative marketing campaigns and improve customer service experiences by anticipating needs.

Ultimately, there isn’t an easy answer when it comes to whether or not AI impacts financial customer privacy negatively or positively.